Every little thing You Need to Know About Equity Loan

Every little thing You Need to Know About Equity Loan

Blog Article

Exploring the Benefits of an Equity Car Loan for Your Monetary Objectives

Amidst the selection of monetary tools offered, equity loans stand out for their possible benefits in helping individuals to reach their monetary objectives. The advantages that equity finances supply, varying from adaptability in fund usage to possible tax obligation advantages, present a compelling situation for factor to consider.

Flexibility in Fund Use

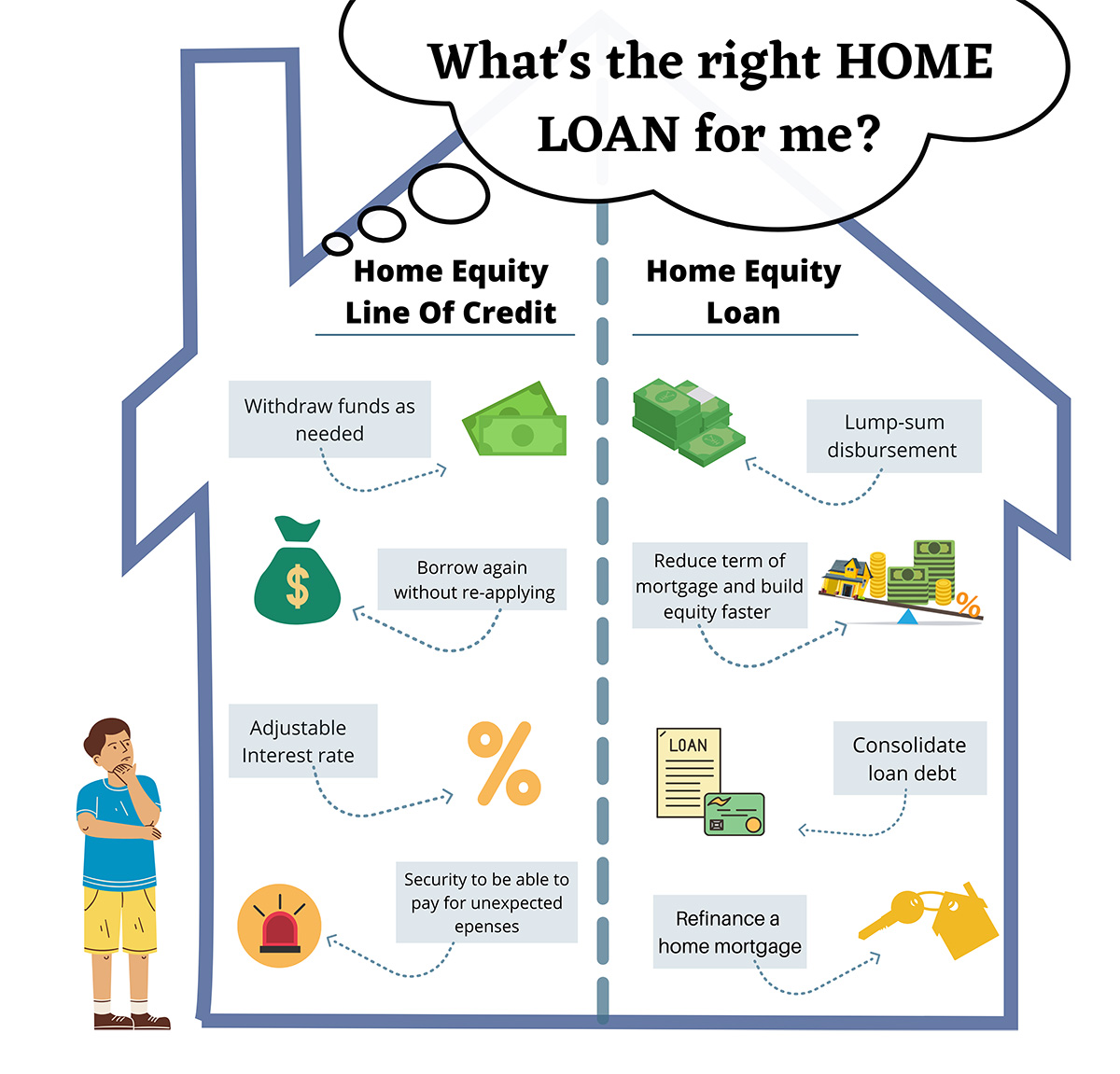

Flexibility in utilizing funds is a vital advantage associated with equity loans, providing customers with functional alternatives for managing their funds effectively. Equity financings permit people to access a line of credit based on the equity they have built up in their homes.

Additionally, the adaptability in fund use expands to the quantity borrowed, as debtors can commonly access a large amount of cash relying on the equity they have in their residential property. This can be especially useful for people looking to fund substantial expenditures or tasks without resorting to high-interest choices. By leveraging the equity in their homes, consumers can access the funds they require while gaining from potentially lower rate of interest compared to other forms of borrowing.

Potentially Reduced Rate Of Interest Rates

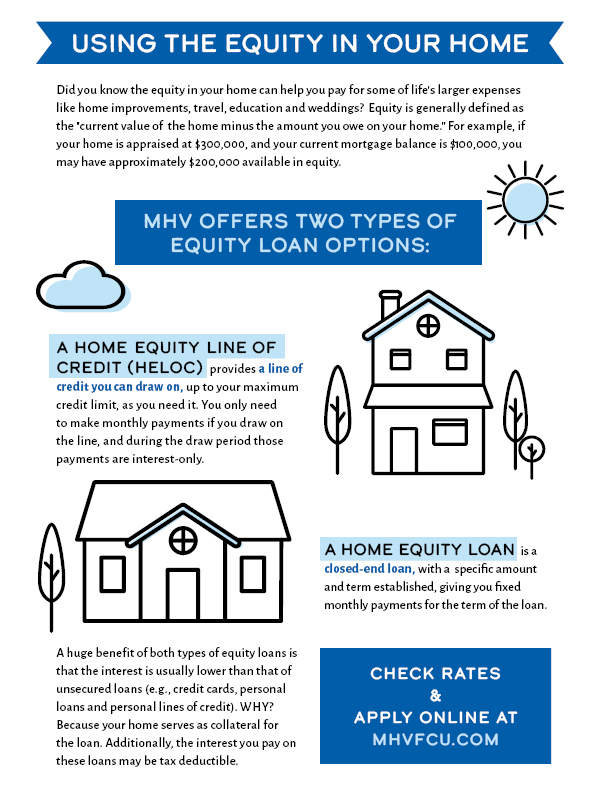

When considering equity finances, one may find that they provide the potential for reduced rate of interest prices compared to alternate loaning alternatives, making them an eye-catching economic selection for many people. This benefit comes from the truth that equity financings are safeguarded by the borrower's home equity, which lowers the threat for lenders. Because of this lowered level of threat, loan providers are often prepared to use lower rate of interest on equity financings than on unsecured car loans, such as individual fundings or charge card.

Lower rate of interest can cause considerable cost financial savings over the life of the funding. By securing a reduced rate of interest price through an equity loan, customers can potentially reduce their total interest expenditures and reduced their month-to-month payments. This can free up funds for various other monetary objectives or expenses, ultimately boosting the borrower's monetary placement over time.

Accessibility to Larger Finance Amounts

Provided the capacity for lower rate of interest with equity financings as a result of their safeguarded nature, consumers may likewise take advantage of accessibility to larger loan amounts based on their available home equity. This accessibility to larger finance quantities can be useful for people looking to money significant financial goals or jobs (Home Equity Loan). Whether it's for home restorations, debt loan consolidation, education and learning expenditures, or various other considerable investments, the capacity to borrow more cash via an equity car loan provides debtors with the monetary flexibility required to attain their objectives

Potential Tax Obligation Benefits

Securing an equity financing might use possible tax obligation advantages for consumers seeking to maximize their monetary benefits. In lots of instances, the rate of interest on an equity financing can be tax-deductible, similar to mortgage passion, under certain conditions.

In addition, making use of an equity loan for home renovations may likewise have tax obligation advantages. By utilizing the funds to restore or enhance a key or second home, homeowners may enhance the residential property's value. This can be helpful when it comes time to offer the residential or commercial property, potentially minimizing capital gains taxes or perhaps receiving certain exemption limits.

It is important for customers to seek advice from a tax professional to completely understand the details tax ramifications and advantages associated with equity car loans in their private scenarios. Alpine Credits.

Faster Approval Refine

Final Thought

In recap, an equity lending uses versatility in fund use, potentially lower rate of interest, access to bigger car loan quantities, potential tax obligation benefits, and a quicker approval procedure. These benefits make equity loans a practical choice for individuals wanting to accomplish their monetary objectives (Alpine Credits Equity Loans). It is necessary to very carefully consider the terms of an equity financing prior to choosing to guarantee it lines up with your certain financial needs and goals

Provided the potential for lower rate of interest rates with equity loans due to their secured nature, customers may likewise benefit from accessibility to bigger finance amounts based on their readily available home equity (Equity Loan). In contrast, equity lendings, leveraging the equity in your home, can supply a quicker authorization process because the equity offers as security, minimizing the risk for lending institutions. By selecting an equity loan, consumers can speed up the car loan authorization process and accessibility the funds they need immediately, providing a valuable economic service throughout times of necessity

Report this page